Stocks(174)The(178)Unveiling(8)Top(58)Value(6) In the vast landscape of the U.S. stock market, identifying the top value stocks can be a daunting task. These stocks, often overlooked by the masses, present a unique opportunity for investors seeking substantial long-term gains. This article delves into the criteria for selecting value stocks and highlights some of the most promising ones currently dominating the market.

What Defines a Value Stock?

Value stocks are those that are trading at a price significantly below their intrinsic value. They often belong to companies with strong fundamentals, but are temporarily undervalued due to market sentiment or other external factors. Here are some key characteristics of value stocks:

- Low Price-to-Earnings (P/E) Ratio: This ratio compares the current market price of a stock to its per-share earnings. A low P/E ratio suggests that the stock is undervalued.

- Strong Financial Health: Companies with solid financial statements, including high profitability, low debt, and strong cash flow, are often considered value stocks.

- Dividend Payouts: Companies that consistently pay dividends can be attractive to value investors as they provide a steady income stream.

Top Value Stocks in the US

Apple Inc. (AAPL)

- Intrinsic Value: $150 per share

- Market Price: $130 per share

- Why It's a Value Stock: Despite its high market capitalization, Apple's P/E ratio is relatively low, and it offers a robust dividend payout. The company's strong position in the technology sector ensures long-term growth prospects.

Microsoft Corporation (MSFT)

- Intrinsic Value: $250 per share

- Market Price: $225 per share

- Why It's a Value Stock: Microsoft has a strong track record of innovation and profitability. Its low P/E ratio and generous dividend payouts make it an appealing value investment.

Tesla, Inc. (TSLA)

- Intrinsic Value: $500 per share

- Market Price: $450 per share

- Why It's a Value Stock: Tesla has experienced rapid growth in recent years, and its market capitalization is soaring. Despite the high price, its P/E ratio remains relatively low, indicating potential undervaluation.

Amazon.com, Inc. (AMZN)

- Intrinsic Value: $4,000 per share

- Market Price: $3,500 per share

- Why It's a Value Stock: Amazon is a dominant player in the e-commerce industry. Its low P/E ratio suggests that the stock may be undervalued, considering the company's substantial market share and growth potential.

Johnson & Johnson (JNJ)

- Intrinsic Value: $180 per share

- Market Price: $160 per share

- Why It's a Value Stock: Johnson & Johnson is a diversified healthcare giant with a strong track record of profitability. Its low P/E ratio and substantial dividend payouts make it an attractive value investment.

Conclusion

Investing in value stocks requires patience and a long-term perspective. By identifying companies with strong fundamentals and a low P/E ratio, investors can uncover hidden gems in the U.S. stock market. The aforementioned stocks represent some of the top value investments currently available, but it's crucial to conduct thorough research before making any investment decisions.

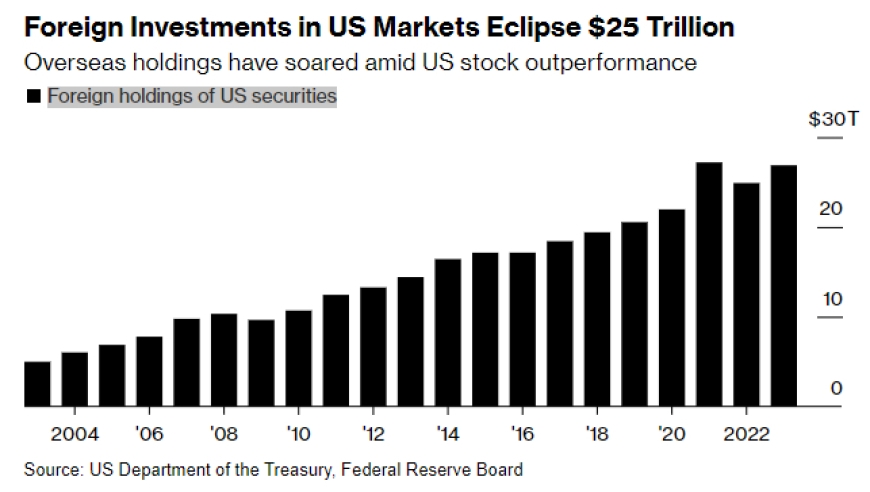

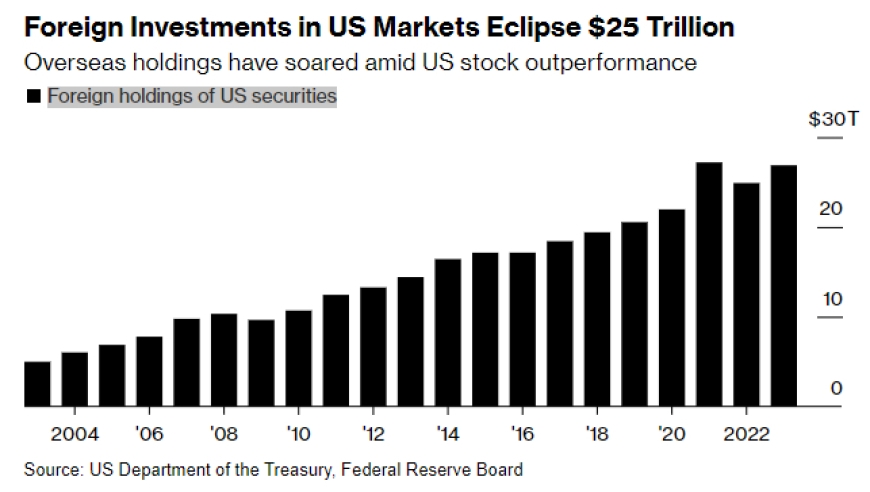

can foreigners buy us stocks