In the ever-evolving world of finance, understanding equity market statistics is crucial for investors, traders, and financial analysts. These statistics provide valuable insights into the performance and trends of the stock market, enabling informed decision-making. This article delves into the key aspects of equity market statistics, offering a comprehensive overview for those looking to navigate the complexities of the stock market.

Market Capitalization and Index Performance

One of the fundamental aspects of equity market statistics is market capitalization. This metric represents the total value of all shares of a company and is a key indicator of its size and influence in the market. By analyzing market capitalization, investors can gauge the overall health of the market and identify potential investment opportunities.

Another critical element is the performance of major stock market indices. Indices like the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite serve as benchmarks for the overall market performance. Tracking these indices allows investors to understand the broader market trends and make informed decisions based on historical data.

Volatility and Trading Volume

Volatility is another crucial factor in equity market statistics. It measures the degree of price fluctuations in a stock or the overall market. High volatility can indicate uncertainty and risk, while low volatility suggests stability. Investors often use volatility to assess the risk associated with a particular investment and to time their entry and exit points.

Trading volume is another important metric that reflects the level of activity in the market. Higher trading volume typically indicates greater interest and participation, which can lead to more accurate price discovery. By analyzing trading volume, investors can identify potential trends and patterns in the market.

Sector Performance and Industry Analysis

Equity market statistics also provide insights into the performance of different sectors and industries. By analyzing sector performance, investors can identify areas of strength and weakness within the market. For example, the technology sector has been a significant driver of market growth over the past decade, while the energy sector has faced challenges due to geopolitical and environmental factors.

Industry analysis is another critical aspect of equity market statistics. It involves examining the performance of companies within a specific industry and identifying trends and patterns. For instance, the healthcare industry has seen significant growth due to advancements in medical technology and an aging population.

Dividend Yield and Earnings Growth

Dividend yield is a key metric for income-oriented investors. It represents the percentage of a company's earnings paid out to shareholders in the form of dividends. Higher dividend yields can be attractive for investors seeking steady income streams.

Earnings growth is another important factor in equity market statistics. Companies with strong earnings growth potential are often considered attractive investments. By analyzing earnings reports and historical data, investors can identify companies with promising future prospects.

Case Studies: Apple and Tesla

To illustrate the importance of equity market statistics, let's consider two prominent companies: Apple and Tesla.

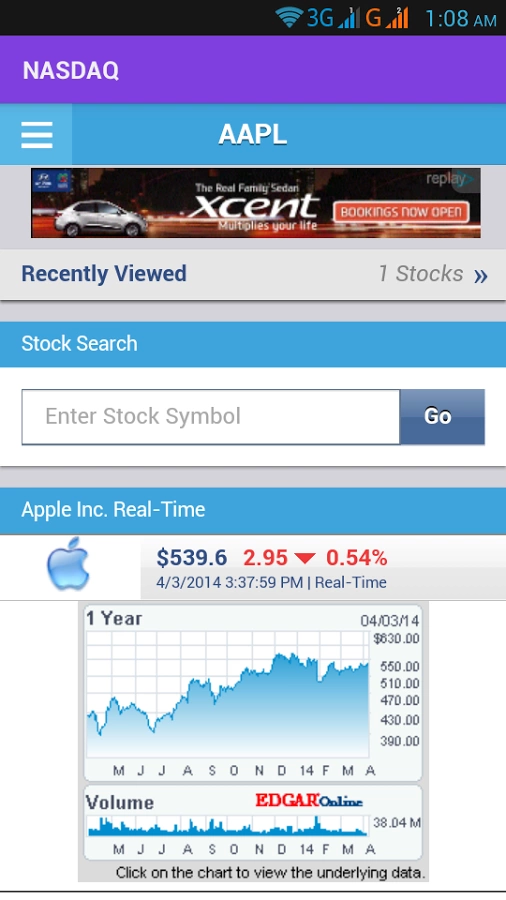

Apple, a technology giant, has seen significant growth in its market capitalization and earnings over the years. Its strong dividend yield and consistent earnings growth have made it a favorite among investors.

Tesla, on the other hand, has experienced high volatility and rapid growth. Its market capitalization has surged as the company has become a leader in the electric vehicle industry. However, its high volatility and earnings uncertainty have also made it a risky investment for some.

By analyzing these companies' equity market statistics, investors can gain valuable insights into their performance and potential future prospects.

In conclusion, understanding equity market statistics is essential for navigating the complexities of the stock market. By analyzing market capitalization, index performance, volatility, trading volume, sector performance, and other key metrics, investors can make informed decisions and identify potential investment opportunities. By staying informed and analyzing the data, investors can increase their chances of success in the dynamic world of equity markets.

can foreigners buy us stocks