In the dynamic world of technology, microcap tech stocks have emerged as a lucrative investment opportunity for savvy investors. These stocks, often overshadowed by their larger counterparts, offer potential for significant growth and high returns. In this article, we delve into the world of microcap tech stocks in the United States, exploring their unique characteristics, benefits, and risks.

Understanding Microcap Tech Stocks

Microcap tech stocks refer to shares of technology companies with a market capitalization of less than $300 million. These companies are often in the early stages of growth, focusing on innovative technologies and disruptive business models. Unlike their larger peers, microcap tech stocks are not as well-known or widely followed, making them less likely to be influenced by market sentiment.

Benefits of Investing in Microcap Tech Stocks

High Growth Potential: Microcap tech stocks have the potential to offer higher returns than larger, established companies. This is because they are often in the early stages of growth and have the opportunity to scale rapidly.

Access to Disruptive Technologies: Investing in microcap tech stocks allows investors to gain exposure to cutting-edge technologies and innovative business models. This can be particularly beneficial in industries that are rapidly evolving, such as artificial intelligence, blockchain, and renewable energy.

Attractive Valuations: Microcap tech stocks are often undervalued compared to their larger counterparts. This provides investors with an opportunity to purchase shares at a lower price, potentially leading to significant gains as the company grows and its valuation increases.

Risks of Investing in Microcap Tech Stocks

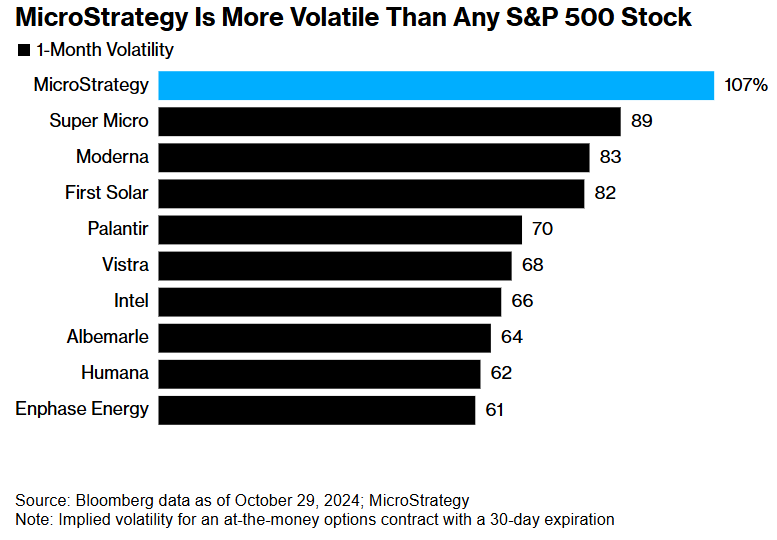

High Volatility: Microcap tech stocks can be highly volatile, experiencing significant price fluctuations due to various factors, including market sentiment, news, and company performance.

Lack of Liquidity: These stocks may not be as liquid as those of larger companies, making it more difficult to buy or sell shares without impacting the stock price.

Higher Risk of Failure: Microcap tech stocks are often in the early stages of development, which means they are more likely to fail than established companies. This increases the risk of losing your investment.

Case Study: Tesla, Inc.

A prime example of a microcap tech stock that turned into a multibillion-dollar success is Tesla, Inc. In 2003, when Tesla was founded, it was a microcap tech stock with a market capitalization of just a few million dollars. Over the years, Tesla has revolutionized the automotive industry with its electric vehicles and innovative technologies. Today, Tesla is one of the most valuable companies in the world, with a market capitalization of over $500 billion.

Conclusion

Investing in microcap tech stocks in the United States can be a lucrative opportunity for investors looking to gain exposure to innovative technologies and potentially high returns. However, it is crucial to carefully evaluate the risks and benefits before investing in these stocks, as they can be highly volatile and carry a higher risk of failure.

cusip stock lookup