In the fast-paced world of finance, understanding the stock exchange is crucial for anyone looking to invest or trade. The stock exchange serves as a marketplace where shares of public companies are bought and sold. This article delves into the essentials of stock exchange trading, providing you with the knowledge to navigate this dynamic environment successfully.

Understanding the Stock Exchange

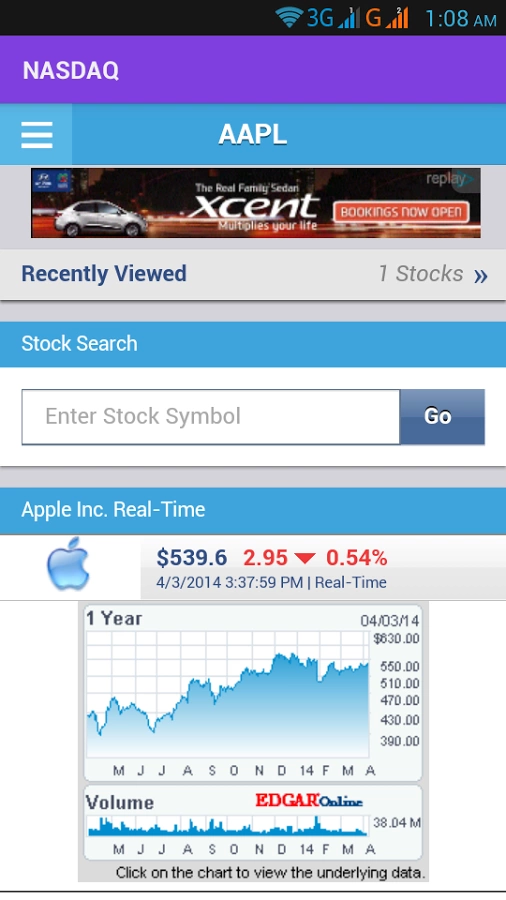

The stock exchange is essentially a platform where investors can buy and sell shares of publicly traded companies. These exchanges operate as regulated markets, ensuring fair trading practices and maintaining the integrity of the financial system. The most well-known stock exchanges in the United States include the New York Stock Exchange (NYSE) and the NASDAQ.

Types of Stock Exchanges

There are two main types of stock exchanges: organized and over-the-counter (OTC). Organized exchanges, like the NYSE, have specific rules and regulations for listing companies. OTC markets, on the other hand, are less regulated and typically involve smaller companies or thinly traded stocks.

The Role of Brokers

When trading on the stock exchange, investors often use the services of a broker. A broker is a professional who buys and sells stocks on behalf of their clients. They act as intermediaries between the investor and the exchange, executing trades and providing market analysis and advice.

Key Terminology

Before diving into stock exchange trading, it's important to familiarize yourself with some key terminology:

Strategies for Trading

To succeed in stock exchange trading, it's crucial to develop a solid trading strategy. Here are some essential strategies to consider:

Case Study: Amazon's Rise

One notable example of a company that has thrived on the stock exchange is Amazon. When Amazon went public in 1997, its initial share price was

Conclusion

Understanding the stock exchange is essential for anyone looking to invest or trade in the stock market. By familiarizing yourself with key concepts, developing a solid trading strategy, and staying informed about market trends, you can increase your chances of success. Whether you're a seasoned investor or just starting out, the stock exchange offers a world of opportunities.

new york stock exchange