In the fast-paced digital age, managing your finances has never been easier, thanks to innovative apps like the Microsoft Money App. This user-friendly tool offers a wide array of features that cater to both personal and business financial management. Whether you're a seasoned budgeter or just starting out, this guide will explore the ins and outs of the Microsoft Money App, helping you take control of your finances like never before.

Understanding the Microsoft Money App

The Microsoft Money App is a versatile financial management tool that allows users to track their spending, manage their budget, and invest wisely. With its intuitive interface and robust features, it's no wonder why it has become a favorite among personal finance enthusiasts and small business owners alike.

Key Features of the Microsoft Money App

Expense Tracking: Track your spending with ease using the app's expense tracking feature. Simply categorize your expenses and watch as your spending habits become crystal clear.

Budgeting: Create and manage a budget that fits your financial goals. The app's budgeting tools help you allocate funds to different categories, ensuring you stay on track with your financial objectives.

Investment Management: Monitor your investments and make informed decisions with the app's investment management features. Keep tabs on your portfolio's performance and stay updated on market trends.

Bank and Credit Card Syncing: Sync your bank and credit card accounts to the app for real-time updates on your transactions. This feature ensures that your financial information is always up to date.

Financial Insights: Gain valuable insights into your financial habits with the app's financial insights feature. Receive personalized recommendations and tips on how to improve your financial well-being.

How to Get Started with the Microsoft Money App

Download the App: Download the Microsoft Money App from your device's app store. The app is available for both iOS and Android devices.

Create an Account: Sign up for a free account using your email address and password.

Link Your Accounts: Connect your bank and credit card accounts to the app for seamless financial tracking.

Set Up Your Budget: Create a budget that aligns with your financial goals and track your spending accordingly.

Monitor Your Finances: Regularly review your financial data to stay informed about your financial status.

Case Study: Transforming Your Finances with the Microsoft Money App

Let's consider the case of Sarah, a young professional who struggled with managing her finances. After downloading the Microsoft Money App, Sarah was able to track her spending, create a budget, and monitor her investments. Within a few months, she noticed a significant improvement in her financial health. By staying on top of her expenses and making smart investment decisions, Sarah was able to save for her future goals and reduce her debt.

Conclusion

The Microsoft Money App is a powerful tool that can help you take control of your finances. With its wide range of features and user-friendly interface, it's no wonder why it's becoming the go-to app for financial management. Start using the Microsoft Money App today and experience the benefits of better financial health for yourself.

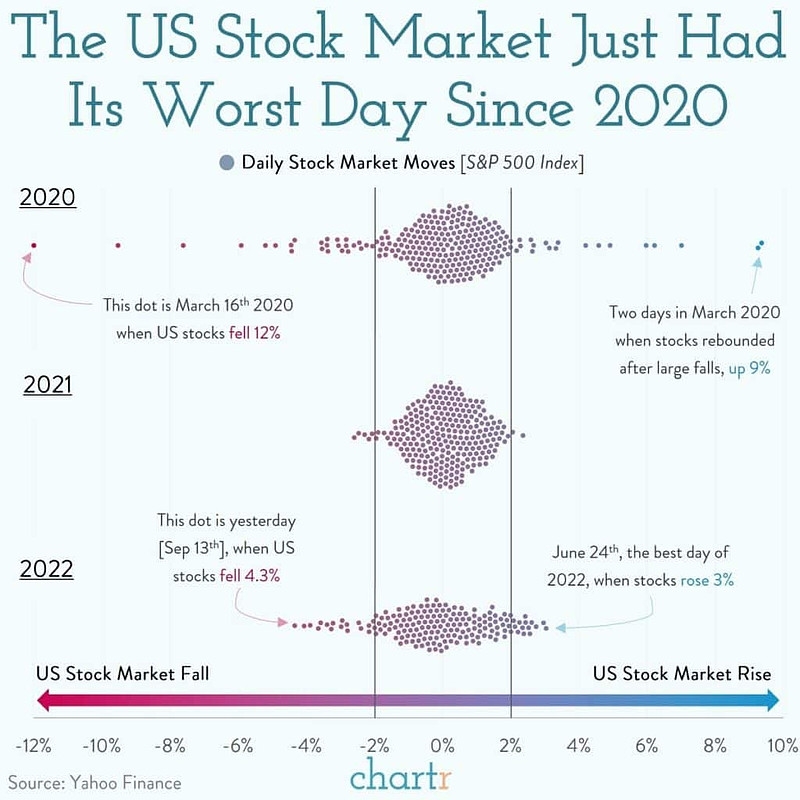

new york stock exchange