The US stock market has been a major driver of economic growth and wealth creation over the years. Its performance is closely watched by investors, businesses, and policymakers alike. In this article, we delve into the current state of the US stock market, exploring recent trends, potential risks, and opportunities for investors.

Recent Trends in the US Stock Market

The US stock market has experienced a strong rally in recent years, with the S&P 500 Index reaching record highs. This can be attributed to several factors, including low interest rates, strong corporate earnings, and a growing economy. However, the market has also faced several challenges, such as trade tensions and geopolitical uncertainties.

The Impact of Trade Tensions

Trade tensions between the US and China have been a major concern for investors. The ongoing trade war has led to increased tariffs on goods and services, which has had a negative impact on corporate earnings. Companies that rely heavily on exports to China have been particularly affected, leading to a decline in their stock prices.

Geopolitical Uncertainties

Geopolitical uncertainties, such as tensions in the Middle East and the ongoing conflict in Ukraine, have also contributed to market volatility. These uncertainties can lead to a decrease in investor confidence, which can, in turn, lead to a sell-off in the stock market.

Opportunities for Investors

Despite the challenges, there are still opportunities for investors in the US stock market. The technology sector, for example, has been a major driver of growth, with companies like Apple, Microsoft, and Amazon leading the way. The healthcare and consumer discretionary sectors are also expected to perform well in the coming years.

Case Study: Apple Inc.

A prime example of a company that has thrived in the current market environment is Apple Inc. Despite facing challenges such as increased competition and trade tensions, Apple has continued to grow its revenue and earnings. The company's strong product lineup, including the iPhone, iPad, and Mac, has helped it maintain its market dominance.

The Role of Low Interest Rates

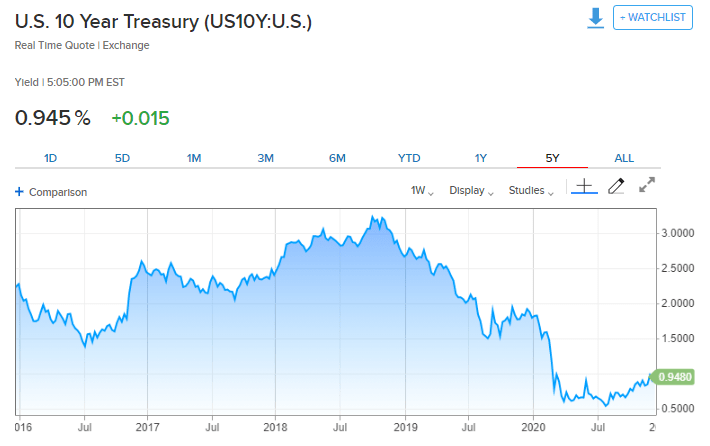

Low interest rates have also played a significant role in the strong performance of the US stock market. With borrowing costs at historic lows, companies have been able to invest in new projects and expand their operations. This has, in turn, led to increased corporate earnings and higher stock prices.

Conclusion

The US stock market has been performing well in recent years, driven by factors such as low interest rates, strong corporate earnings, and a growing economy. However, investors should remain cautious about the potential risks, such as trade tensions and geopolitical uncertainties. By diversifying their portfolios and staying informed about market trends, investors can navigate the complexities of the stock market and achieve their investment goals.

us flag stock