Investing is a critical component of financial planning, and the decision on where to invest your hard-earned money is a significant one. One common question among investors is whether they should focus solely on U.S. stocks. This article delves into the advantages and disadvantages of investing exclusively in U.S. stocks, providing you with the information needed to make an informed decision.

Diversification and Risk Management

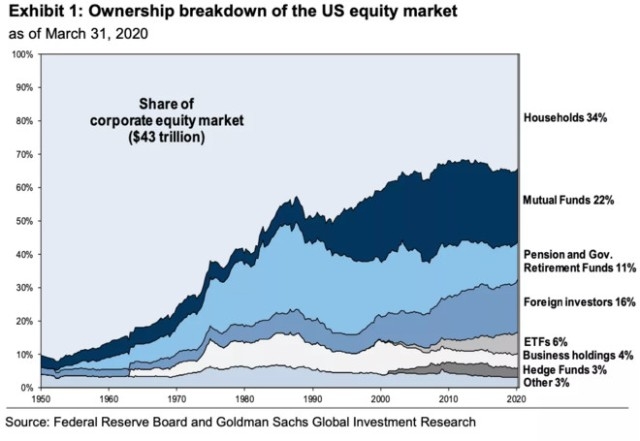

Diversification is a key principle in investment strategy. By spreading your investments across various asset classes, industries, and geographical locations, you can mitigate the risk associated with any single investment. Investing solely in U.S. stocks could expose you to a higher level of risk compared to a diversified portfolio.

Geographical Diversification can provide protection against economic downturns in any one region. For instance, if the U.S. economy faces a recession, having investments in other countries can help offset potential losses. Global markets have historically shown to be less correlated, meaning that a downturn in one market may not necessarily lead to a downturn in another.

The U.S. Market's Advantages

Despite the importance of diversification, there are several advantages to investing in U.S. stocks:

The Downside of Investing Only in U.S. Stocks

While investing in U.S. stocks has its benefits, there are also drawbacks:

Case Studies

To illustrate the potential risks and rewards of investing in U.S. stocks, let's consider two case studies:

Conclusion

Investing in only U.S. stocks has its advantages, but it also comes with risks. Diversifying your portfolio to include stocks from various regions and industries can help mitigate these risks and potentially increase your returns. Ultimately, the decision should be based on your investment goals, risk tolerance, and time horizon.

us stock market live