In the fast-paced world of finance, staying updated with current stock exchange prices is crucial for investors and traders. Whether you're a seasoned pro or just starting out, understanding the dynamics of stock prices can significantly impact your investment decisions. This article delves into the factors influencing current stock exchange prices and provides a comprehensive guide to help you navigate the stock market effectively.

Understanding Current Stock Exchange Prices

Current stock exchange prices are determined by the supply and demand for a particular stock. When demand for a stock increases, its price tends to rise, and vice versa. Several factors can influence the supply and demand dynamics, including:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can impact investor sentiment and, subsequently, stock prices.

- Company Performance: A company's financial performance, including earnings reports, revenue growth, and profit margins, can significantly influence its stock price.

- Market Sentiment: The overall mood of the market can also affect stock prices. For example, during a bull market, investors are optimistic, leading to higher stock prices, while during a bear market, investors are pessimistic, leading to lower stock prices.

- News and Events: News related to a company, industry, or the broader economy can cause stock prices to fluctuate. This includes earnings announcements, mergers and acquisitions, and regulatory changes.

Navigating the Stock Market

To navigate the stock market effectively, it's essential to stay informed about current stock exchange prices and the factors influencing them. Here are some tips to help you get started:

- Use Reliable Sources: Ensure you use reliable sources for current stock exchange prices, such as reputable financial news websites, stock market apps, and official stock exchanges.

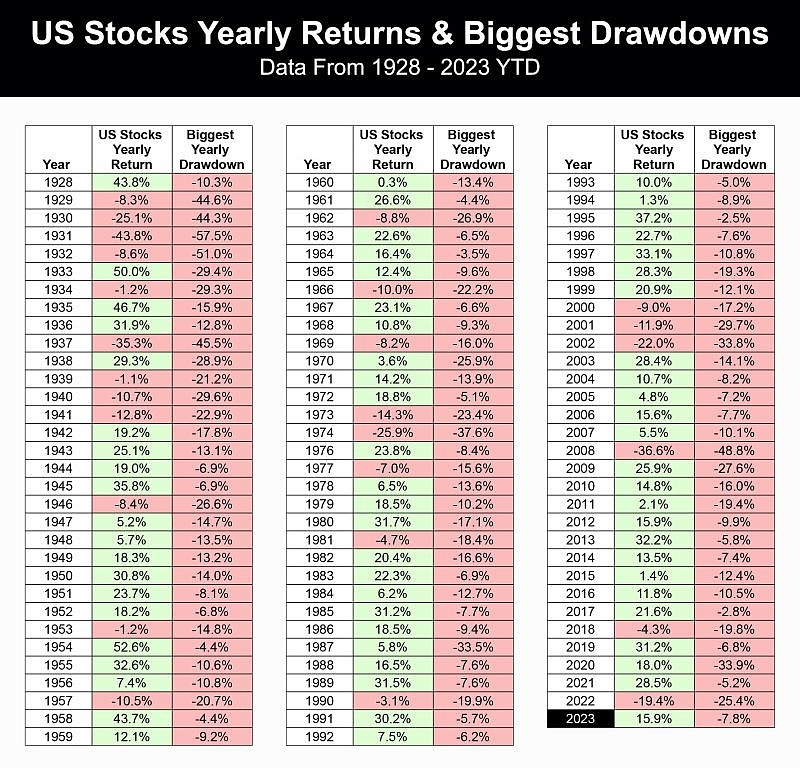

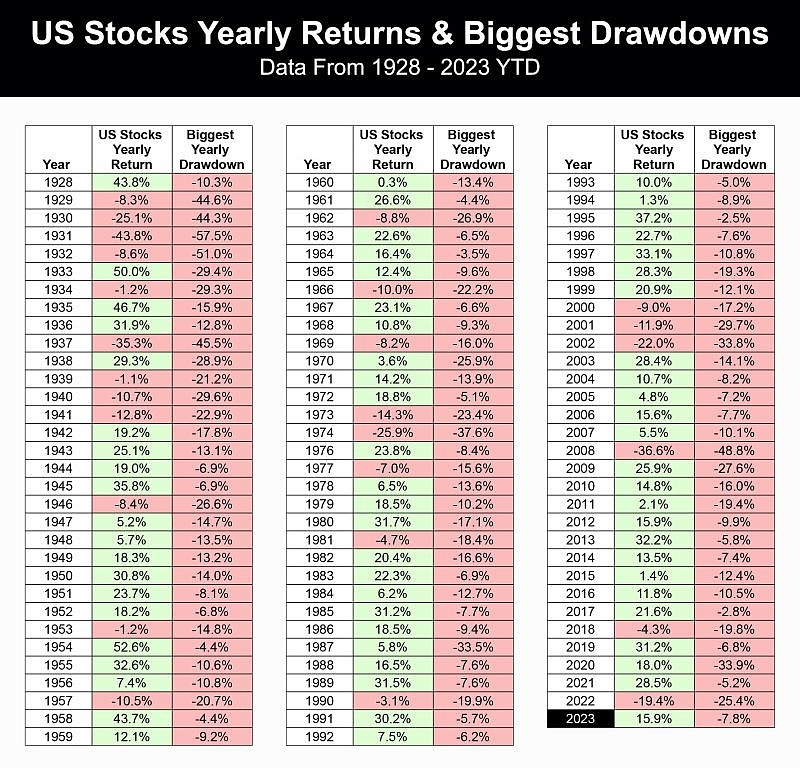

- Analyze Historical Data: Analyzing historical stock prices can provide insights into a stock's price trends and potential future movements.

- Diversify Your Portfolio: Diversifying your portfolio can help mitigate risks associated with fluctuations in stock prices.

- Stay Disciplined: Stick to your investment strategy and avoid making impulsive decisions based on short-term market movements.

Case Study: Apple Inc. (AAPL)

Let's consider a case study involving Apple Inc. (AAPL), one of the world's most valuable companies. In the past few years, AAPL's stock price has been influenced by various factors:

- Economic Indicators: During the COVID-19 pandemic, economic indicators such as GDP growth and unemployment rates were negatively affected, leading to uncertainty in the market. However, AAPL's strong financial performance and resilience during the pandemic helped its stock price remain relatively stable.

- Company Performance: AAPL's consistent revenue growth and profit margins have contributed to its strong stock performance. The company's innovative products, such as the iPhone and iPad, have driven demand and increased investor confidence.

- Market Sentiment: The overall market sentiment has also played a role in AAPL's stock price. During periods of optimism, AAPL's stock price has risen, while during periods of pessimism, it has experienced some volatility.

Conclusion

Staying informed about current stock exchange prices is essential for making informed investment decisions. By understanding the factors influencing stock prices and following the tips outlined in this article, you can navigate the stock market effectively and achieve your investment goals.

us stock market today live cha