In today's fast-paced world, managing finances effectively is crucial for achieving long-term success. Whether you're a student, a young professional, or a seasoned executive, understanding the basics of finances can make a significant difference in your life. This article delves into essential tips for mastering finances, helping you make informed decisions and secure a prosperous future.

Budgeting: The Foundation of Financial Success

One of the most critical aspects of managing finances is budgeting. Creating a budget allows you to track your income and expenses, ensuring that you live within your means. Here are some tips for effective budgeting:

Investing: Growing Your Wealth

Investing is a powerful tool for growing your wealth over time. Here are some key points to consider when investing:

Saving: Building a Financial Safety Net

Saving money is essential for creating a financial safety net and achieving your long-term goals. Here are some tips for saving effectively:

Case Study: The Savvy Student

Let's consider the case of Sarah, a college student who wants to master her finances. Sarah starts by creating a budget, tracking her spending, and setting realistic goals. She allocates a portion of her income to savings and invests in a diversified portfolio of index funds. By staying focused on her long-term goals, Sarah successfully builds a financial safety net and secures her future.

Conclusion

Mastering finances is a journey that requires dedication and discipline. By following these essential tips, you can create a solid financial foundation and achieve your long-term goals. Remember to stay informed, stay focused, and stay committed to your financial journey.

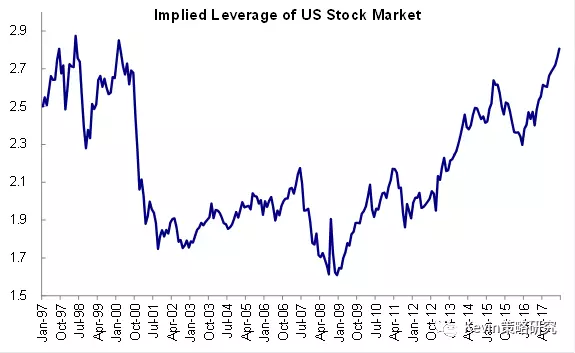

us stock market live